This article was republished with permission from dermotcole.com.

From the Anchorage Daily News Monday after action by the Biden administration approving the Willow oil project by ConocoPhillips to be built on the North Slope: “Alaska’s congressional delegation said during a call with reporters Monday morning that the decision was a landmark moment and a critical step that will boost state revenue by billions of dollars, create more than 2,000 jobs and help the state’s long-struggling economy recover.”

Yes, over a period of decades the project could boost state revenue by billions of dollars.

But that is not the full picture. And there is something seriously wrong with the full picture.

Unless there is a change in state law, state revenue will decline by $1 billion to $1.6 billion during the development and early operational years of the Willow project because of a gift to the oil industry in state oil tax law, according to state reports from 2018 and 2023.

The latest analysis says the state won’t have a positive cumulative cash flow from Willow until 2035.

ConocoPhillips is allowed to write off the expenses of developing Willow, which is on federal land, against the oil taxes due the state from production at profitable Prudhoe Bay and elsewhere on the North Slope. Here is a column I wrote about this last week.

The state tax decline will be pronounced in the years before oil production starts, reaching a peak in 2028 or so. There will also be a decline in the state corporate income tax because of increased spending by the company.

The negative impact over a decade from GMT-1, GMT-2 and Willow could be a decline of $200 million to $300 million a year for eight years or so of early development, according to this 2018 analysis by the administration of Gov. Bill Walker.

So-called “ring fencing” that limited the ability of a company to transfer costs to reduce taxes this way was part of Alaska’s oil tax system until 2006 and would have been reinstated under the oil tax initiative rejected by voters in 2020.

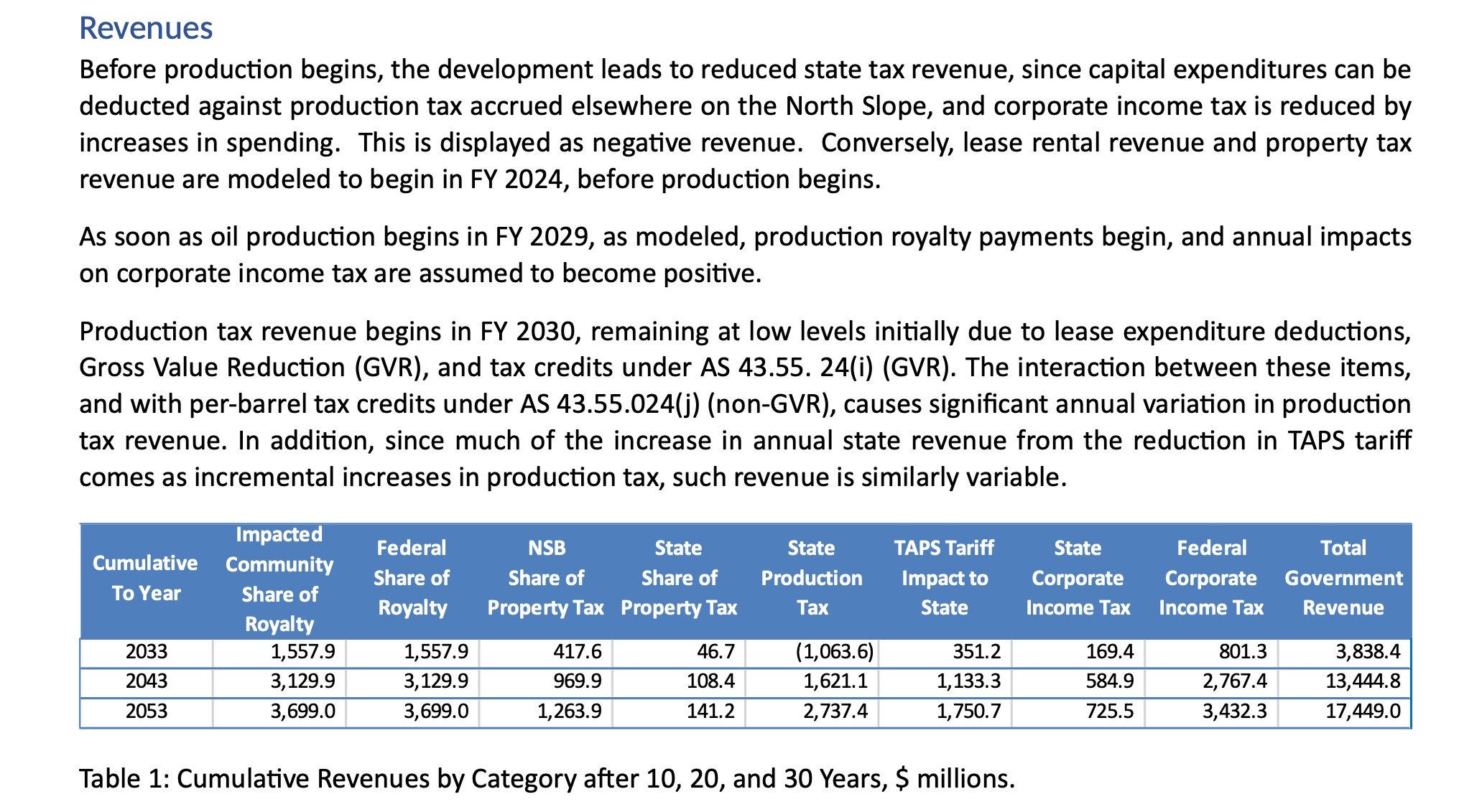

The Walker administration report estimated the negative impact of the Willow development at $1.6 billion over a decade. By the end of the second decade, the positive impact would be about $3.8 billion, without adjusting for inflation.

A new analysis from the Dunleavy administration blurs the picture for the public, but acknowledges that there will be big drops in state production taxes, totaling $1 billion by 2033.

The new report from the Dunleavy administration Revenue Department, dated Feb. 28, can be found here. It was released to legislators, but doesn’t appear to be posted online.

A second reason why Willow will not lead to an increase in state revenue for many years is a provision in a 1980 federal law that requires 50 percent of the royalties from the project will be used for grants with a priority given to “subdivisions of the state most directly or severely impacted by development of oil and gas leased” within NPR-A.

Over the last four decades the subdivisions of the state on the North Slope have been deemed to be those most directly or severely impacted. The grants can be used for planning, building, running, repairing of “essential public facilities.”

Before 1984, 50 percent of the NPR-A funds went to the Permanent Fund, but that was found by the courts to conflict with the federal law. The state produces an annual report on the grant program.

In early 2019, Natural Resources Commissioner Corri Feige estimated that about $300 million a year could be generated for the grant program for five North Slope villages and the North Slope Borough because of the Willow project. The total would be in excess of $2 billion over the life of the project. The North Slope Borough would also see higher revenues from property taxes.

The new analysis from the Dunleavy administration, which downplays the losses in production taxes and income taxes in the early years and stresses the billions that will follow, says that on a net present value basis, there will be more cash flow from the project to the North Slope villages and the North Slope Borough—by far—than to the state.

Notably absent from the Dunleavy administration analysis is any suggestion that changes are needed in the oil tax system, despite the project leading to a $1 billion decline in oil production taxes by 2033.

From the Dunleavy administration Willow analysis released in February.

A new analysis from the Dunleavy administration says that the North Slope villages and the North Slope Borough, on a net present value basis, will gain far more than the state treasury in future cash flow.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673